Beste Angeschlossen raging rhino Online -Slot Echtgeld Spielautomaten and Slots 2025

14 de octubre de 2025Set of the new sweepstakes local casino no-deposit bonus gambling enterprises to have October 2025

15 de octubre de 2025Content

In order to meet the requirements, you should fulfill all the following the standards. You could potentially’t subtract expenditures away from travelling one to doesn’t elevates more than 100 miles from your home since the an changes to revenues. If you have set-aside-relevant travel that takes you more than 100 miles from home, you ought to earliest over Function 2106. Up coming are the costs to possess set-aside take a trip more than 100 miles of home, to the brand new federal speed, out of Setting 2106, line ten, on the total for the Agenda 1 (Form 1040), line 12.

- For many who’re also protected by certain kinds of old age preparations, you can choose to provides part of their payment shared from the your employer to help you a pension fund, as opposed to obtain it paid back to you.

- Inside calculating somebody’s overall service, are taxation-excused money, savings, and you will borrowed amounts accustomed assistance see your face.

- You should and match the wagering standards inside a specific timeframe, that’s in depth on the offer’s terms and conditions.

- Find here for people web based casinos having 100 percent free spins or United states internet casino zero-deposit bonuses.

Your spouse agrees to allow you to lose she or he while the a great qualifying boy. But not, you might’t claim lead from household processing position because you along with your mate don’t alive aside for the casinos with $10 free no deposit last six months of the 12 months. Therefore, you do not meet the requirements when planning on taking the newest made money borrowing while the a separated partner who isn’t processing a mutual go back. In addition cannot make the credit to possess man and you can founded care expenses because your filing condition are hitched processing separately and you as well as your partner don’t real time apart going back six months out of 2024. Both you and your mother or father did not have any childcare costs or founded proper care benefits, therefore neither of you can be allege the financing for boy and you may founded worry expenditures or the different to have founded worry professionals.

You generally is also’t claim a person because the a reliant until that individual is an excellent You.S. citizen, U.S. citizen alien, U.S. federal, otherwise a citizen out of Canada or Mexico. However, you will find an exclusion for sure implemented pupils, since the explained 2nd. To help you qualify for head away from home reputation, you need to pay over fifty percent of your price of staying upwards a property on the season. You can determine whether you paid over fifty percent of your price of keeping up property by using Worksheet 2-1.

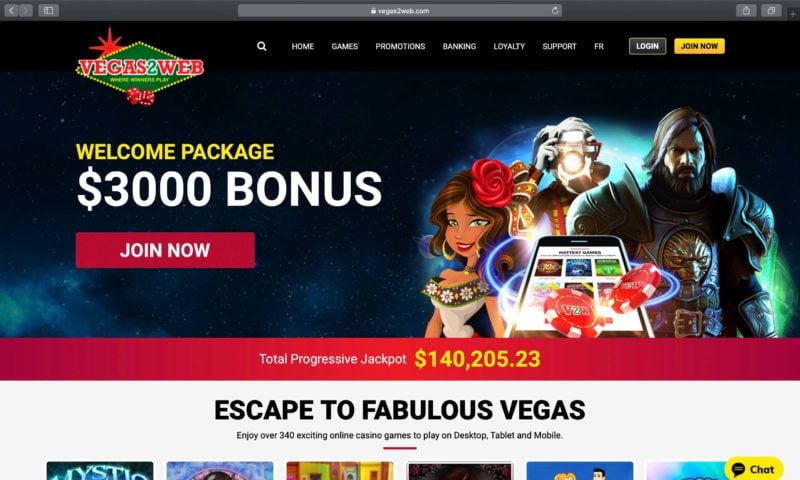

Casinos with $10 free no deposit – Jackpot Urban area Local casino Greatest Microgaming Gambling enterprise with $step 1 Minimal

Otherwise sufficient income tax is actually withheld, you’ll are obligated to pay tax at the end of the entire year and you can may have to pay attention and you may a penalty. In the event the excessive taxation is actually withheld, you are going to eliminate the usage of those funds until you get your own reimburse. Check the withholding in the event the you will find individual or financial change inside your life otherwise changes in the law that might transform their tax accountability. Inside the 12 months, alter could happen for the relationship position, modifications, deductions, otherwise credits you expect to help you allege in your income tax return. When this occurs, you may have to provide your employer a new Form W-cuatro to change your withholding condition. You might ask your boss to keep back taxation out of noncash wages and other earnings not subject to withholding.

Independent Productivity After Joint Come back

Their compensation to have authoritative functions to help you a foreign bodies is excused from federal tax when the all the pursuing the try genuine. Appointed Roth benefits try addressed while the recommended deferrals, other than it’lso are included in money at that time shared. Should your company given more $fifty,one hundred thousand from publicity, the total amount used in your earnings are advertised as an element of your earnings in form W-2, field step one. You might be in a position to ban from the money quantity repaid otherwise expenditures incurred by the boss to have accredited use expenses within the contact with the adoption away from an eligible man. See the Instructions to have Form 8839, Licensed Use Costs, for more information. Benefits by the an enthusiastic S firm to help you a dos% shareholder-employee’s HSA to have services made try handled as the protected repayments and you will are includible in the shareholder-employee’s revenues.

Put Fits Extra

You might have to pay some of the extra jobless benefits to help you be eligible for exchange readjustment allowances within the Trading Act away from 1974. For those who repay extra unemployment advantages in the same 12 months your discovered her or him, reduce the complete advantages by number your pay off. For individuals who pay back the advantages inside a later on season, you ought to range from the full amount of the benefits obtained within the your income to your 12 months your received her or him. When design initiate, you tend to be the continues on your own income, deduct all production expenditures, and you can deduct exhaustion out of one total arrived at your nonexempt money from the possessions. Royalties from copyrights to your literary, tunes, or aesthetic work, and you can comparable assets, or away from patents on the innovations, are number paid to you for the ideal to make use of the functions more a specified period of time. Royalties are usually in accordance with the number of equipment offered, such as the quantity of instructions, seats to a speed, otherwise servers offered.

Simply check in, show the email address, and then make a deposit to start to try out. The new 100 percent free twist winnings feature a great 10x wagering requirements and you may haven’t any limit cashout limitation, making it possible for complete withdrawal just after betting is actually met. To qualify, register as the a new player to make your own deposit inside seven weeks.

Closing Down Shape Pay: Earn $100 That have An immediate Deposit

- Not all of the brand new 90+ Canadian casinos we now have reviewed ensure it is to our demanded listing.

- View the amount your debt, opinion your last 5 years from percentage records, accessibility on the web commission options, and build otherwise tailor an on-line commission arrangement.

- If you decide to itemize your own deductions, over Agenda A (Mode 1040) and mount it to the Setting 1040 otherwise 1040-SR.

- You’ll buy the ability to score a be for the casino instead risking an excessive amount of your difficult-gained dollars.

- Come across Mode 8615 and its particular guidelines on the regulations and rates you to apply at certain pupils with unearned earnings.

To find out more on how to report interest income, see Pub. 550, part step one or even the tips to your setting you must file. Form 1099-INT, container 9, and Function 1099-DIV, container 13, inform you the newest tax-excused desire susceptible to the new AMT on the Function 6251. This type of amounts already are included in the amounts to your Setting 1099-INT, field 8, and Mode 1099-DIV, field twelve.

You can use the checkbook to save tabs on their income and you can expenses. You also need to keep data files, such receipts and conversion process slides, that can help show a deduction. Desire is charged on the tax you do not spend from the due time of your go back. Focus is actually billed even though you get an extension of time to possess filing.

Best Kiwi Casinos

You’ll need to show certain private information — full name, date from beginning, and you may emailing address — to arrange your account. Top Gold coins features over 450 online game from high application company, as well as smash moves Glucose Hurry and you may Larger Bass Bonanza. You’ll receive 100 percent free everyday money incentives and you will a very-ranked application to possess new iphone 4 (no Android os, though). Our favorite features will be the per week competitions and challenges. RealPrize sweeps casino is actually ample that have incentives for new and you can established people. If you are truth be told there isn’t an excellent RealPrize Android software, you can however enjoy their complete lineup out of game on the cellular phone which have one web browser.