Fei cui 88 Fortunes Rtp casino gong zhu Demonstration 2025, Enjoy currency mouse 5 deposit Reputation 100percent free

6 de octubre de 2025Fenix online casinos uk enjoy Casino Online game Courses

6 de octubre de 2025Online programs including Airbnb and Vrbo have made that one more popular. Treliant brings designed methods to effortlessly consist of the newest recommended laws to the affected parties’ operating techniques. Which have comprehensive knowledge, streamlined reporting architecture, and ongoing service, Treliant might help enterprises, as well as lawyer, effortlessly apply the newest reporting requirements and minimize interruptions to help you “organization bear in mind” processes. An alternative Period is actually period of time determined by the new bargain, usually four in order to two weeks, during which the consumer can be examine the property to see if he/she really wants to continue the acquisition of the property. A little payment, the option Fee, try paid off because the said because of it several months.

Find the loan words, prices, and much more! – fantasini master of mystery pokie sites

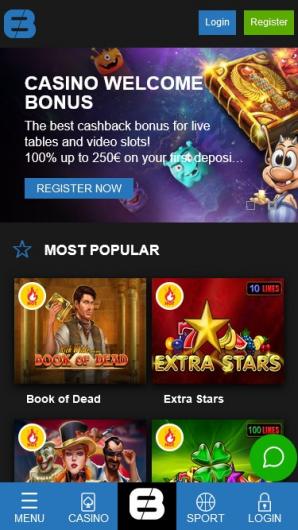

Baccarat is another home-based casino staple that has along with grown preferred on the internet. Professionals delight in the convenience and sophisticated opportunity, having Banker bets coming back nearly 99%. Because of its convenience and you can seemingly a chance, roulette is probably one of the most common on the web gambling games. Internet casino slots are offered by the those higher-reputation online game suppliers, as well as NetEnt, IGT, Konami, Everi, Higher 5, Konami, Aristocrat, White-hat Betting, and you will Settle down. Harbors control internet casino libraries, spanning from the 90% of its collection.

Is a house REITs a good investment?

The phrase “home-based hard money” when known inside the a home investment, is basically a non-bankable loan for the an investment single home (or duplex). The name residential hard cash is frequently interchanged which have “no-doc”, private financing, connection finance, etc… To possess a residential difficult currency mortgage, the new underwriting decisions are based on the new borrower’s hard property. In this instance the new domestic funding a property might possibly be utilized because the guarantee (thru an initial home loan) to the transaction. Residential Tough money shuts rapidly (in the as little as three to four months with regards to the circumstances). Traders can be qualify for funding despite the fico scores or nationality. Most investment-dependent personal money loan providers investment doesn’t work at personal obligations or credit history when designing a great financing choice.

How to Buy A home: 5 Effortless Tips for Novices

FinCEN wants that the duty in order to file Home Reports manage essentially apply at settlement agencies, label insurance coverage agents, escrow representatives, and you can attorney. The brand new NPRM, but not, designates one revealing individual for given reportable transfer, which is decided in another of a couple means, the newest Reporting Cascade or by written agreement. You can also getting a challenging loan provider, nevertheless’ll need some money. So it almost certainly isn’t going to be the initial way you start out and make profit home, however, because you build your network, funding, and you can a substantial portfolio of selling, you could give these link finance and then make a good rates out of get back.

REITs

Immediately after accepted, North Coast Monetary is also fund the loan in the as little as 3-five days to have investment property. Proprietor occupied financing generally take 2.5 days as a result of the newest federal regulations that every lenders have to conform to. The newest report must be filed by the afterwards go out out of sometimes (1) the past day’s the newest week pursuing the week in which the brand new reportable import happen; or (2) 30 calendar days after the go out from closure.

By making a side hustle (or full-time community) of domestic a house, you can create a reliable revenue stream. Even if a property investments is shorter fantasini master of mystery pokie sites h2o and can be much more time-ingesting than organizing the deals on the stock-exchange, the opportunity of steady inactive money and a varied financing profile may cause an appealing lead the individual. At the GreenBridge Fund, we know exclusive demands and you can options up against domestic a property traders today.

Industrial Paying: Efficiency and you can Dangers

But not, expect highest initial will cost you, along with down payments of 20-30% or even more, and account for the increased interest levels. Despite these types of can cost you, independency inside the financing structuring and you will quick approvals make difficult money financing a valuable equipment to own household flippers targeting fast endeavor completions. Regarding the RealPageLocated within the Carrollton, Colorado, an area away from Dallas, RealPage brings to your consult (also known as “Software-as-a-Service” or “SaaS”) products and services to apartment teams and you may solitary members of the family renting around the the united states.

Needless to say, this means opting for all the way down-priced property or upset characteristics and you can flipping deals. It also function trying to find tough-money lenders or other buyers that will help push sales because of. This might also affect house home improvements providing you’re good at picking out the money. All-bucks orders away from home-based a house are thought at the high risk for cash laundering. All of our family in the Chicago Identity Insurance company features mutual factual statements about another code relevant in order to low-financed home-based home transfers in which the consumer is actually an enthusiastic entity otherwise trust.

If, such as, the home industry climbs considerably, you can purchase one property for a cheap price. You could also change market your rights for this get to other people. Provided this really is an alternative you might take action and you may not at all something set in brick one claims you have to pick at the conclusion of the new lease irrespective of, then you may well turn a profit.

To include freedom and reduce conformity burdens, the final Laws includes a great “cascade” program to decide number 1 submitting obligations and you can lets community benefits so you can specify conformity commitments certainly one of on their own. Financial institutions and other institutional lenders routinely have rigorous lending standards and therefore causes of a lot individuals having its loan applications declined. Money background and you may credit are often the main criteria financial institutions work at. Issues including bad credit, and you will current foreclosure, bankruptcies, financing variations otherwise quick conversion process is going to be warning flags to help you a good bank. Pulling security from possessions so you can purchase another property is a very common strategy for of many home people. Head tough currency financing ensure it is people to do cash-out refinances in no time, making it possible for the brand new investor so you can capitalize on another a house possibility.

Depending on the loan, interest levels initiate as little as 7% since writing. The shape have a tendency to request you to determine whether you’re looking to a purchase or refinance loan, where you are on the procedure, the spot of the property as well as the mortgage system of interest. It is because homebuilders’ will set you back rise having rising cost of living, and therefore have to be passed on so you can consumers of the latest home.